Personal Bankruptcy & Debt Relief Solutions

Schedule a Free Consultation Today

Are you overwhelmed by personal debt?

Do you stay up at night worrying how to pay our bills?

Are you stressed every time you get a letter, email or phone call?

Congratulations! You have taken the 1st step to get out of debt.

Many people are overwhelmed by personal debt. The worst thing you can do is nothing: ignoring debt and creditors will not make your bills go away. In fact, ignoring debt collectors makes your situation worse because your debt continues to grow and your credit score keeps going down, making your situation seem hopeless.

There are many different reasons why people get into debt:

Medical bills

Student loans

Job loss

COVID impacts

Credit card debt

Divorce

When you file for bankruptcy your creditors cannot sue you, repossess your car or foreclose on your home.

You are not alone. Thousands of people in Washington state are overwhelmed by personal debt. If you are worried about losing your home, if you are moving your car to avoid repossession, if you are overwhelmed by credit card payments, if your wages are being garnished, if your phone is ringing from creditors calling, if your debts are eating up your monthly income and you are worried about your future and your family’s future, then call us now. Bankruptcy can be easy and painless. The relief you feel when you get a fresh start will be immeasurable.

As you read this, you probably do not even realize how much stress you are under because you’ve slowly gotten used to the stress and become accustomed to the pressure of trying to keep up with your debts. Living with financial pressure has become normal to you. When you file bankruptcy and receive a discharge of your debts and the stress floods away, you will wonder why you didn’t do it sooner.

Bankruptcy is nothing to be embarrassed about.

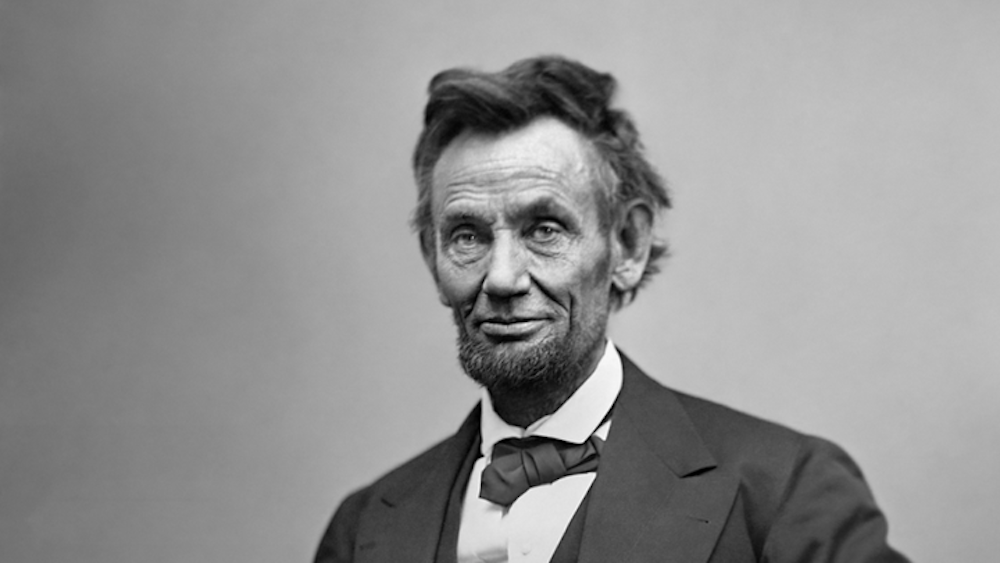

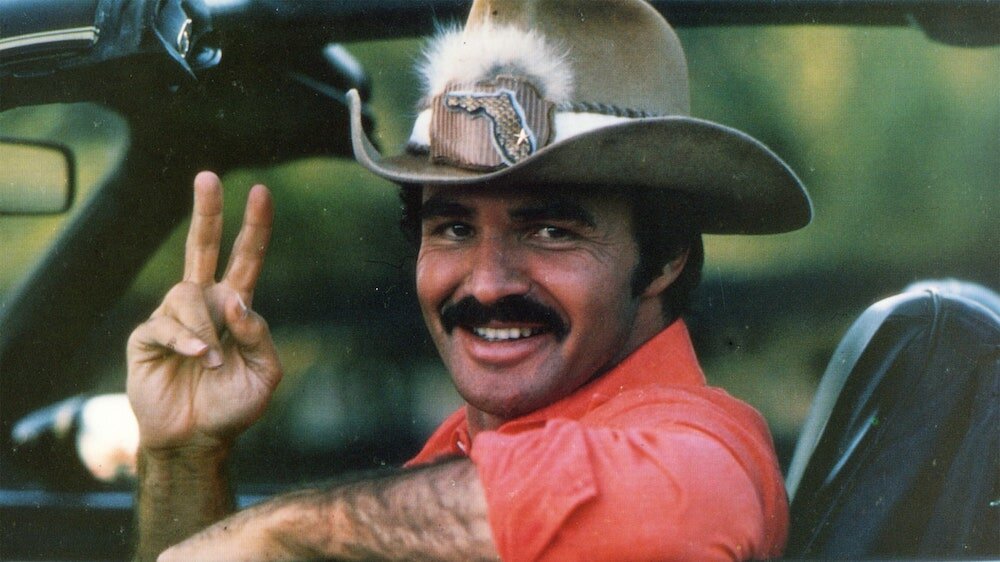

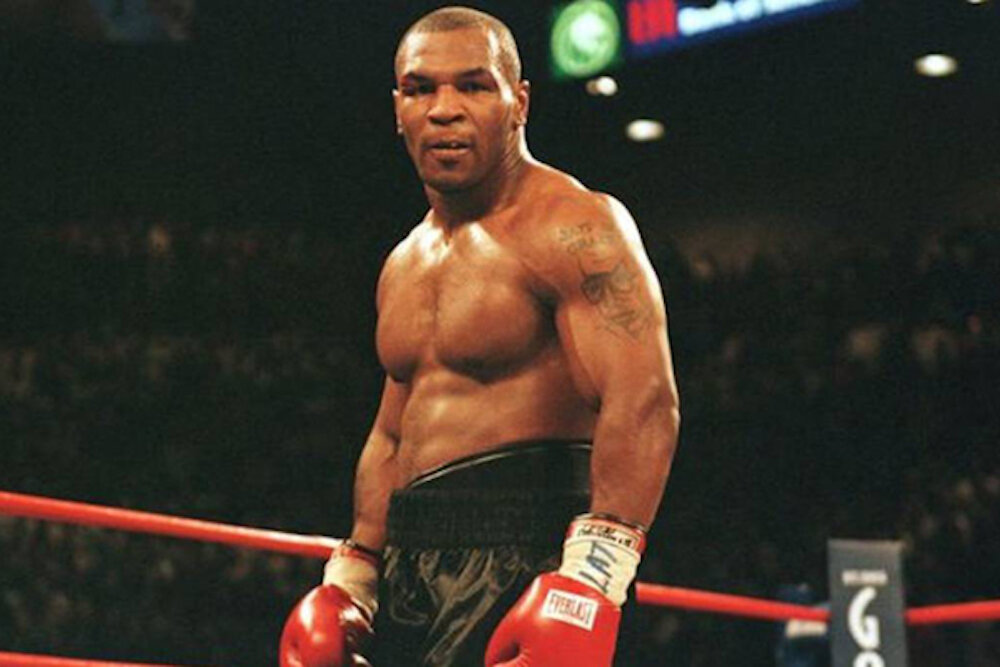

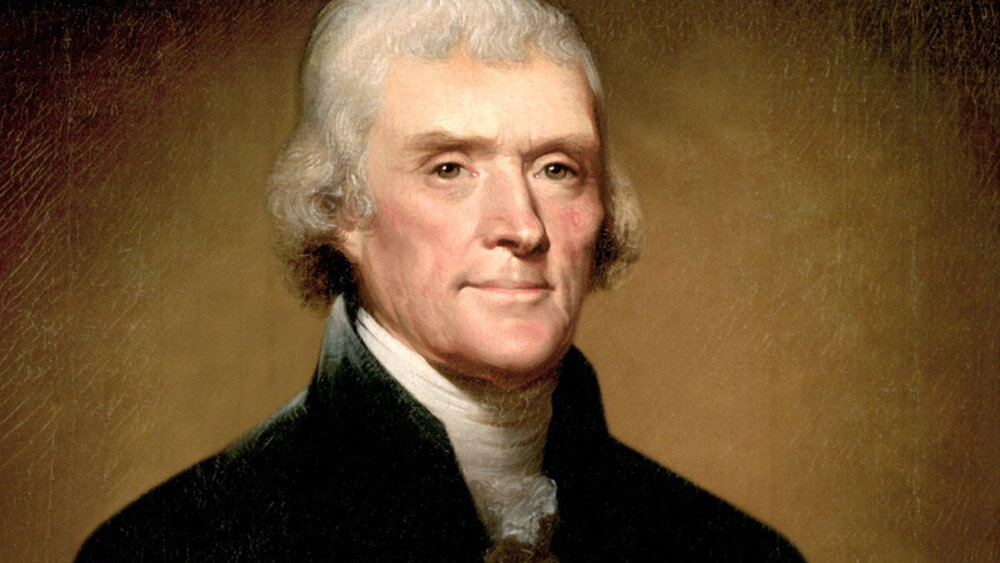

You are in good company. Many successful people have filed bankruptcy to get out of debt, then moved on to great success:

Practice Areas

Chapter 7 Bankruptcy

Most Chapter 7 bankruptcies will be $2500. While the fee is due at the time you file, you can make payments if needed.

Chapter 13 Bankruptcy

Most Chapter 13 bankruptcies will be around $4500, with the opportunity to pay the fee over time, even after filing.

Debt Relief

We can help you fend off debt collectors and provide you with substantial relief under our debt relief program.

The hardest thing is making the decision to file personal bankruptcy. I felt ashamed about the idea of bankruptcy. I took pride in the fact that somehow I was paying off four very large credit cards payments and 2 or 3 monthly loan payments and still surviving on a social worker’s salary. Never mind that I had also fallen behind in rent payments over the years. Had I not been a 20-year tenant who takes care of the grounds, things would have been very different.

I won't forget the first phone call to my attorney Cat—I remember just where I was and how it felt. Cat turned out to be good company and an on-the-ball attorney who knew what she was doing. Cat did a tremendous job on my bankruptcy filing and got great results, especially the negotiation around the car lien, and I am hugely relieved to have some peace of mind now. I really appreciate that Cat took care of business and was also approachable and consoling, when needed. I will always be grateful.